defer capital gains taxes indefinitely

If you have a 500000 portfolio get this must-read guide by Fisher Investments. The capital gains will eventually be taxed when that property is sold or will be deferred again.

Defer Capital Gain and Depreciation Recapture Taxes Indefinitely Never Pay Income Taxes on the Sale of Investment Property.

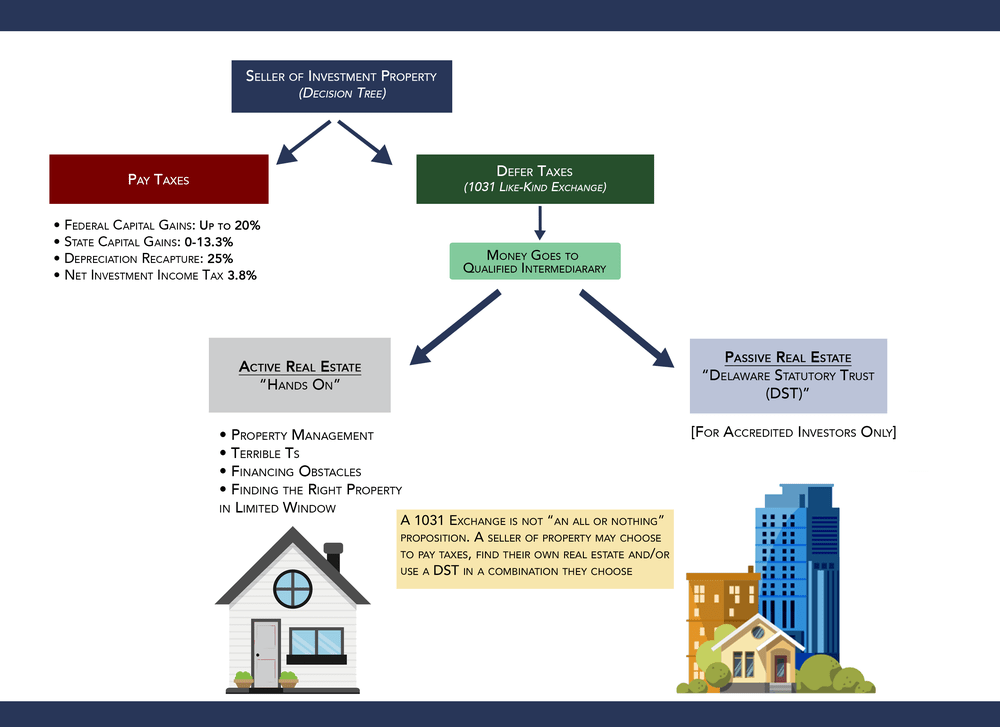

. 2 days agoThese exchanges allow people to defer capital gains taxes when they sell commercial rental or investment real estate as long as the proceeds are used to purchase similar property. Increase Your Value to Your Clients. Sell Commercial Property Postpone Paying Taxes Indefinitely Using Our Unique Proprietary Process 1031 Exchange Avoid Capital Gains Tax Tax Published May 12 2022.

The DST bridges the gap between selling the property and sheltering the capital gains from it. There is a way to accomplish the sale of an asset you own that has grown in value so that you not only defer your capital gains tax for many years but you also exit with cash equivalent to most of the sales proceeds. This deferral can be for as long as the seller chooses.

The DST defers capital gains and other taxation on the sale. Second capital gains placed in Opportunity Funds for a minimum of five years receive a step-up in basis of 10 percent and if held for at least seven years 15 percent. Keep in mind however that gain is deferred but not forgiven in a like-kind exchange and you must calculate and keep track of your basis in the new property you acquired in the exchange.

While investors can defer the tax by means of this strategy it should also be noted that they cannot use a short sale to convert a short-term capital gain into a long-term gain taxed at a lower rate. For realized but untaxed capital gains short- or long-term from the stock sale. 1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment.

Those willing to reinvest and buy more property can defer the capital gains tax with a 1031 exchange. In practice you can defer paying capital gains tax on this money indefinitely if you continue to reinvest it in an EIS each time you dispose of your shares providing you have held them for three years before disposing of them each time. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be able to cash out of the fund 100 tax free.

The Monetized Installment Sale MIS purports to work around this allowing you to have the overwhelming bulk of the proceeds available for whatever purpose you want while still deferring gain. Defer Capital Gain and Depreciation Recapture Taxes Indefinitely. Unlike other installment sales by using a third-party trust the Deferred Sales Trust arrangement can be used to reinvest your.

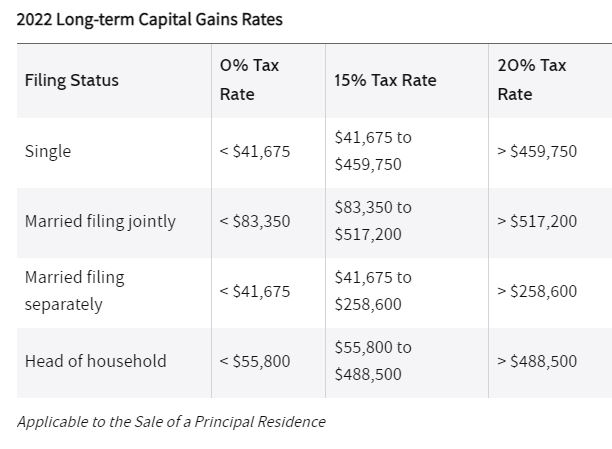

Reduce The Stress And Minimize Your Tax Obligations With Tax Services From A Paro Expert. How to Defer Tax on Capital Gains Tax-Deferred Exchange. 1990 the Inclusion Rate was increased again to 75.

Third they offer an opportunity to permanently avoid. Its entirely possible to roll over the gain from your investment swaps for many years and avoid paying capital gains tax until a property is finally sold. Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange.

While investing in real estate through the buying and selling of property can be a lucrative endeavor in order for an investor to take their efforts - and profits - to the next level they need to learn how to never pay income taxes on the sale of investment property by mastering the art of deferring capital gain depreciation. Real estate agents and. In fact you can walk away with an amount equal to 935 of your net sales proceeds tax deferred.

This means only capital gains from the sale of real estate. Under securities law the investors ownership of the stock ends at the time of the short sale not when the stock is delivered. Those not willing to keep investing in property ready to cash out in other words can also defer capital gains taxes for decades but they need to carefully structure the sale before pulling the trigger to get that deferral.

1988 - the Inclusion Rate was increased from 50 to 6667. The tax on those capital gains is deferred until the end of. January 1 2022 is the 50th anniversary of the capital gains tax.

In recent times the process allows you to trade real estate property used for sale or investment into other real estate property thereby deferring capital gains taxes on the sale of those assets. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. However the Tax Cut and Jobs Act TCJA which took effect on Jan.

Literally the tax consequences of the sale can be deferred indefinitely. The seller then only pays income taxes only on the portion of the taxable capital gains that occur. Buying and selling investment real estate can be incredibly.

Unlike exchange-based tax-deferment methods Deferred Sales Trusts are an instance of a special kind of sale called an installment sale which can be used to defer capital gains taxes by breaking up payments on the sale over multiple installments. For as long as you want though a typical property hold period is seven to eight years. Ad Read this guide to learn ways to avoid running out of money in retirement.

In a nutshell you defer taxes then reduce then you eliminate them. 1972 - it started with a 50 Inclusion Rate and all prior capital gains were exempted. These capital gains defer taxation until the end of 2026 or whenever the asset is disposed of whichever is first.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

High Class Problem Large Realized Capital Gains Montag Wealth

High Class Problem Large Realized Capital Gains Montag Wealth

Short Term Vs Long Term Capital Gains White Coat Investor

Deferred Sales Trust 101 A Complete 2021 Guide Tdr Real Estate Group Hill Country Ranch Sales

Income Tax Deferral Strategies For Real Estate Investors

How To Avoid Capital Gains Tax On Appreciated Stock Positions

Capital Gains Tax Deferral Capital Gains Tax Exemptions

High Class Problem Large Realized Capital Gains Montag Wealth

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Ep 97 1031 Exchanges How To Defer Capital Gains Tax On Properties

Commentary How Californians Can Utilize Dsts To Avoid Capital Gains Tax And Diversify Their Portfolios California Business Journal

Minimizing The Capital Gains Tax On Home Sale Bubbleinfo Com

Capital Gains Full Report Tax Policy Center

Deferred Sales Trust Max Cap Financial

Capital Gains Taxes White Coat Investor

Short Term Vs Long Term Capital Gains White Coat Investor

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)